Why You Need to Master Payroll Accuracy Now (The Stress-Free Way)

- 13 hours ago

- 2 min read

At Contador Accountancy, we believe professionalism doesn’t have to be stuffy. We pride ourselves on being the friendly face of accountancy, providing non-complicated solutions to businesses in Ipswich and beyond.

But if there’s one area where "relaxed" shouldn't mean "casual," it’s payroll.

If there’s one thing we and our clients agree on, it’s this: payroll accuracy is mission-critical. One tiny slip in tax calculations or a missed deduction can cascade into hefty HMRC fines, disgruntled staff, and a reputation that takes years to repair.

The good news? Mastering payroll accuracy doesn’t have to mean sleepless nights or drowning in paperwork.

The Stakes are Higher Than Ever

Industry reports reveal that nearly 60% of payroll errors arise from manual mistakes or outdated data. In uncertain economic times, ignoring payroll risks is like playing with fire.

When payroll goes wrong, it’s more than just a numbers error:

It puts relationships on the line: We value our partnership with you, and we know you value your relationship with your team.

It creates financial hot water: Late payments or wrong statutory deductions lead to legal and financial headaches.

It damages trust: Nothing affects employee morale faster than an incorrect payslip.

Our Solution: BrightPay + Contador Expertise

Our ethos at Contador is to ensure our clients retain control while we deliver value-added services. That’s why we recommend BrightPay as part of our modern cloud accounting toolkit (alongside partners like Xero and Modulr).

Here is how we use BrightPay to keep your business compliant and your team happy:

1. Automated, Precise Calculations

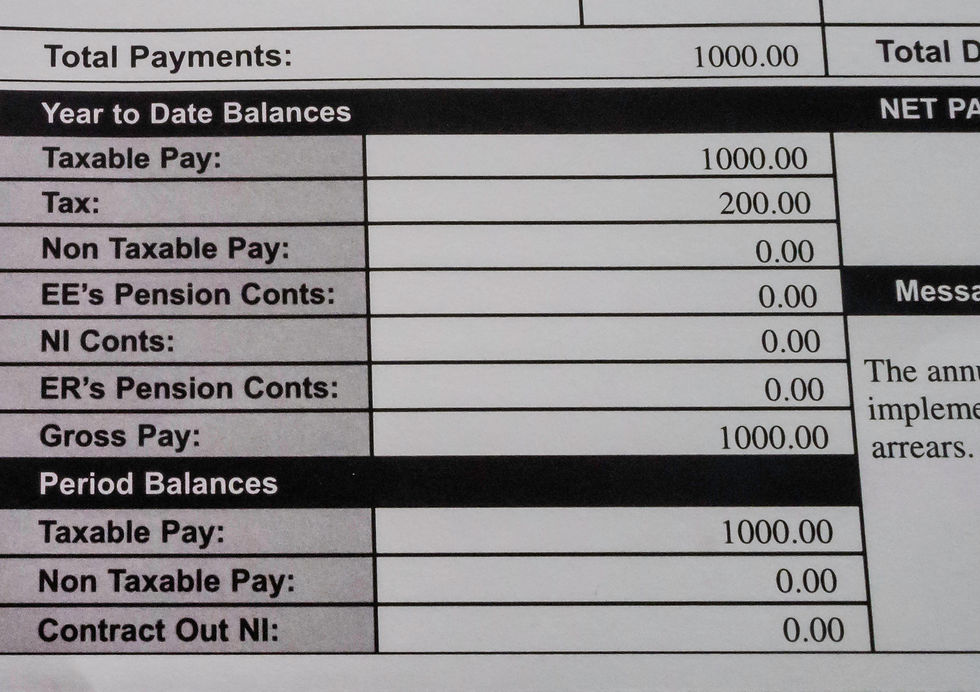

Say goodbye to spreadsheet nightmares. BrightPay’s cloud software calculates taxes, National Insurance, and statutory payments automatically. It has precise legislative compliance baked in, meaning no more second-guessing the figures.

2. Real-Time Validation & "Safety Nets"

Before anything is submitted to HMRC, the software scans for "surprises"—odd starters, missed leavers, or pension glitches. It flags these so we can fix them before they ever become penalties.

3. Instant Legislative Updates

Payroll rules change constantly. BrightPay updates immediately whenever HMRC or regulatory guidance shifts, keeping your reports up to code without you lifting a finger.

4. Audit Readiness & Transparency

We want you to feel empowered, not confused. BrightPay generates detailed, audit-friendly reports and comprehensive logs of all data changes. Whether it's audit season or a simple internal query, you’ll have the transparency you need, 24/7.

Humans vs. Machines: The Contador Touch

Let’s be realistic: no software is perfect. While BrightPay builds formidable guardrails and cuts down on error-prone manual entry, it’s the combination of smart tech and the Contador team’s experience that makes the difference.

By automating the repetitive tasks, we are free to focus on what we do best: proactive advisory, training, and supporting your business growth.

The Path to Stress-Free Payroll

Making payroll stress-free means a seamless workflow and fewer repetitive tasks. With an employee self-service portal and real-time submission status, you can cut down on admin overhead and give your staff peace of mind.

Payroll accuracy matters enormously. In an era where compliance is constantly evolving, managing it manually isn’t just risky—it’s unnecessary.

At Contador Accountancy, we’re here to help you master payroll effortlessly, reliably, and without losing your mind.

Want to see how we can simplify your payroll? Get in touch with the Contador team today.

Comments