Navigating Pre-Budget Anxiety: What Suffolk Businesses Need to Know

- Nov 5, 2025

- 2 min read

For business owners across Suffolk, the weeks leading up to the Chancellor's Budget in late November are often a period of acute anxiety and speculation. The air is thick with "what ifs" concerning changes to everything from VAT thresholds and Corporation Tax to National Insurance contributions and business rates. This nervousness was amplified recently by Chancellor Rachel Reeves' pre-Budget speech, which was widely interpreted as an attempt to "soften the ground" for potential, difficult tax rises. Pre-speech speculation focused heavily on whether she would break key manifesto pledges, and her refusal to rule out increases to income tax, VAT, or National Insurance for the highest earners did little to reassure the business community. While some analysts viewed her candour about the tough economic inheritance and need for "necessary choices" as a positive move toward long-term fiscal stability, for many businesses, the speech had the negative impact of confirming that significant changes—and likely tax hikes elsewhere—are now all but inevitable, thus increasing the need for immediate, proactive financial planning.

Simple Recommendations for the Next Few Weeks

While we all wait for the official announcement, the best strategy is not to panic, but to focus on financial clarity and preparedness. Here are a few simple, sensible steps Contador Accountancy recommends taking in the next few weeks:

Review Your Cash Flow Forecasts:

Stress-test your business by running a few different scenarios: a mild tax increase, a severe one, and a best-case scenario with new reliefs. Knowing your limits will help you react quickly.

Evaluate Capital Expenditure Plans:

If you are considering a significant purchase of equipment or assets, check the current rules for Capital Allowances (like Annual Investment Allowance). The Budget may change the incentives for investment, so understanding the current position is key to acting before the window closes, if necessary.

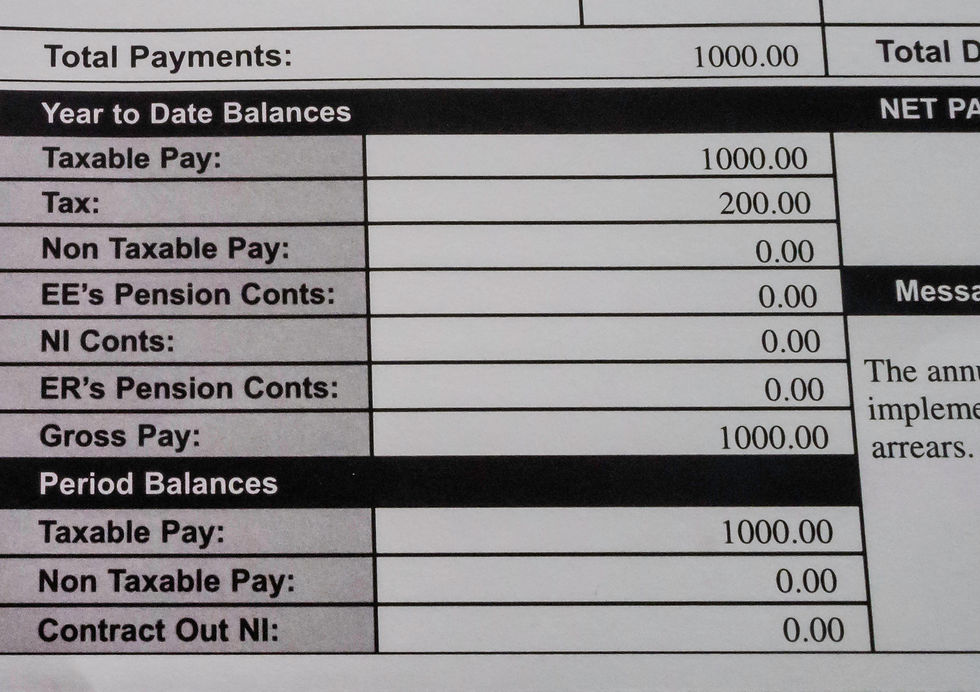

Update Your Payroll and Employer Costs:

Take a close look at your employer National Insurance contributions (NICs) and overall payroll costs. Any changes to employee or employer NICs will be implemented quickly, so having an accurate baseline now will make adaptation smoother.

Check Your VAT Threshold Position:

The VAT registration threshold is a recurring target for change. If your business is near the current threshold, prepare an analysis of the administrative burden and pricing implications should that level be lowered, pulling you into the VAT net.

Utilise Your Accountants:

Do not speculate alone. Get in touch with us at Contador Accountancy. We are actively tracking the most likely policy shifts and can help you develop a flexible, "wait-and-see" strategy tailored specifically to your Suffolk business.

Comments