End of Year Payroll task list

- Mar 19, 2024

- 1 min read

Send your final Full Payment Submission (FPS) on or before your employees’ last payday of the tax year (which ends on 5th April).

If available on your payroll software, put “yes” in the “Final submission for year” field.

It’s a leap year, for weekly, fortnightly or 4 weekly paid staff your “tax week number” field will need to be 53,54 or 56 respectively.

Update employee payroll records from 6th April. Ensure all tax codes are up to date. HM Revenue and Customs (HMRC) will send you a P9T for any employees who need a new tax code.

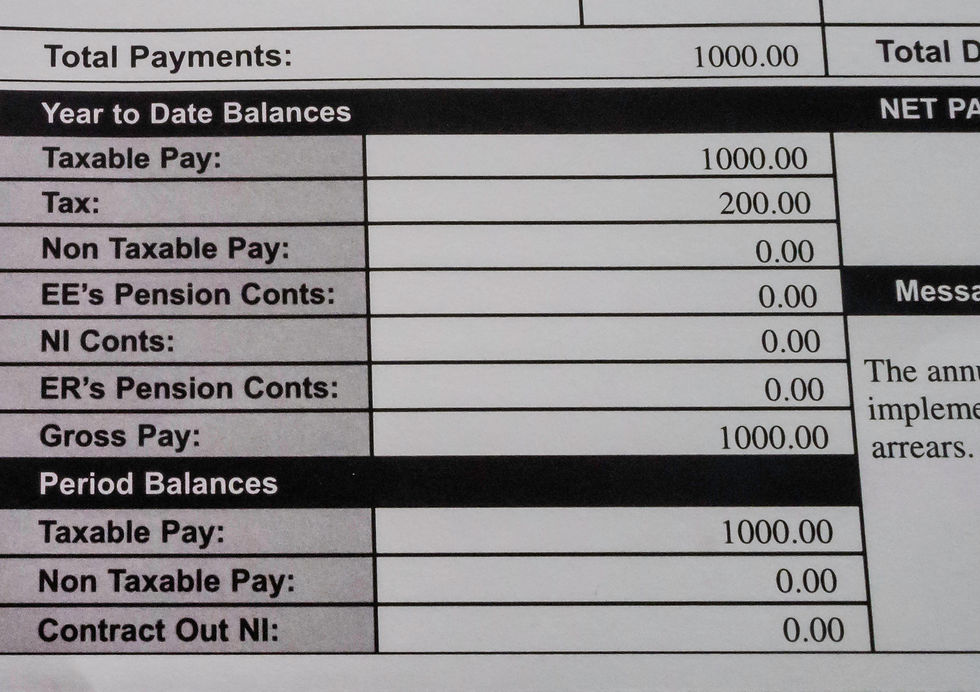

Update your Payroll software. Follow the guidelines of your software provider. Many suggest sending your FPS before downloading the next software update. The new software will update thresholds for income tax, national insurance and any student loan repayments.

By 31st May give your employees a P60.

By 6th July report employee expenses and benefits. Most payroll software has this feature

Alternatively get in touch to see how we can run your payroll for you.

Comments