Budget Breakdown - Supporting Businesses

- Mar 11, 2020

- 1 min read

Updated: Mar 21, 2024

Launching a fundamental review of business rates that will report in the autumn

A new pubs discount will be introduced to take £5,000 off the business rates bills of eligible pubs with a rateable value below £100,000.

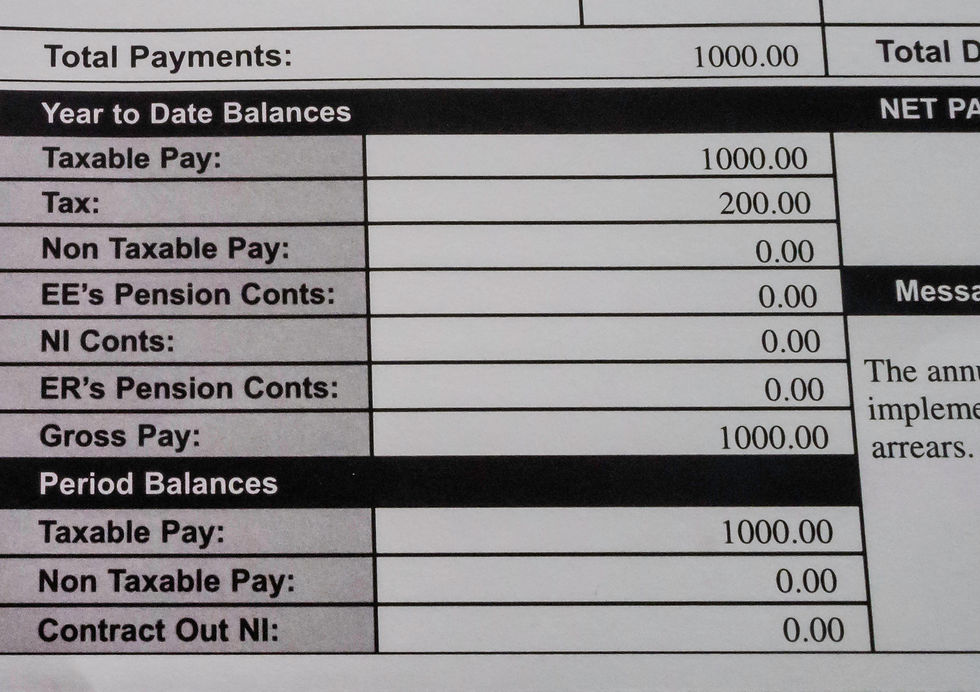

The Employment Allowance for Employer National Insurance Contributions is increasing from £3,000 to £4,000. Over half a million businesses will benefit from this reduction to their costs of employment, with an average gain of £850 per year.

The Structures and Buildings Allowance for Corporation Tax will be increased from 2% to 3%, giving relief on an extra £100,000 next year if you’re buying a building worth £10 million.

£28m package and up to 10,000 Start-Up Loans to support entrepreneurs and businesses to start

Comments