Budget Breakdown - the Public Pocket

- Mar 12, 2020

- 1 min read

Updated: Apr 19, 2024

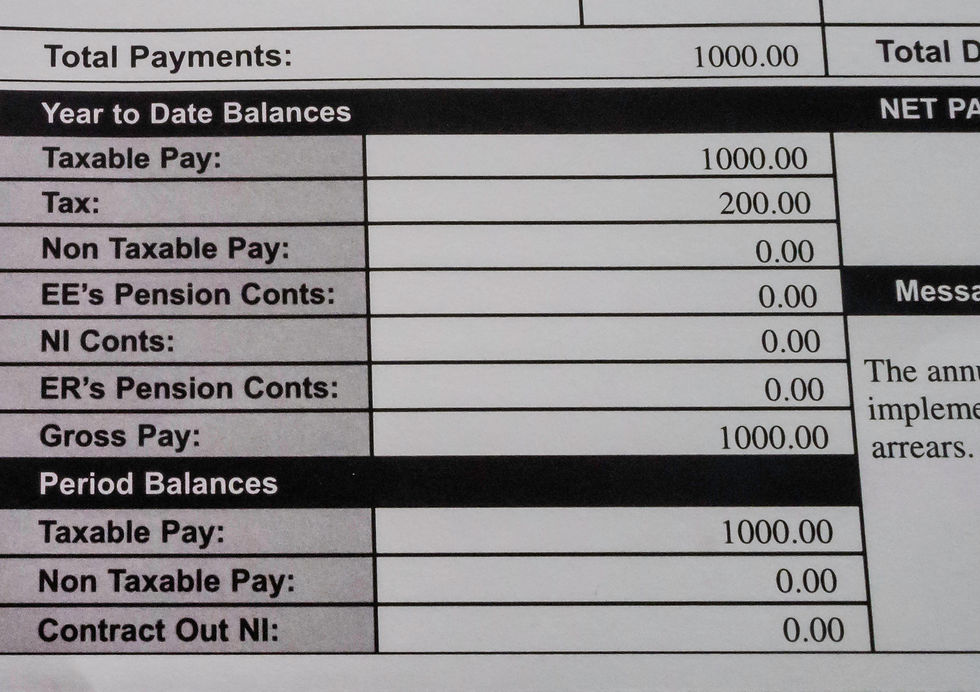

Increasing the National Insurance Contribution thresholds from £8,632 to £9,500, saving a typical employee around £104 a year from April.

Fuel duty will be frozen for the tenth consecutive year

A freeze in duty rates for beer, cider and spirits

Tampon Tax – the 5% rate of VAT on women’s sanitary products – will be scrapped from 1 January 2021

The National Living Wage will increase from £8.21 to £8.72

Ambitious target for the NLW to reach two-thirds of median earnings and to be extended to workers aged 21 and over by 2024

Comments